sales tax oklahoma tulsa ok

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The City has five major tax categories and collectively they provide 52 of the projected revenue.

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

. The Registered Agent on file for this company is Tom H Bruner and is located at 406 S Boulder610 Tulsa OK 74103. The state currently imposes a. The Tulsa Sales Tax is collected by the merchant on.

Sales Tax in Tulsa. The 74112 Tulsa Oklahoma general sales tax rate is 8517. If Oklahoma lawmakers leverage the Sales Tax Relief Credit to reduce or eliminate the impact of grocery taxes this would represent a fiscally prudent way to deliver meaningful.

Rate variation The 74116s tax rate may change depending of the type of purchase. Public Radio Tulsa New from OK Policy. 1 day agoOKLAHOMA CITY -.

Sales Tax Data Systems Inc. 31 rows Norman OK Sales Tax Rate. Is an Oklahoma Domestic For-Profit Business Corporation filed On June 26 1992.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Depending on the zipcode the sales tax rate of Tulsa may vary from 45 to 8517 Every 2022 combined rates mentioned above are the results of Oklahoma state rate 45 the county rate 0367 to 1167 the Tulsa tax rate 0 to 365. Unlike other government entities a city cannot charge property taxes or income taxes.

3015 E Skelly Dr Ste 385. 2 days agoThose months were particularly tough for Oklahomas towns and cities whose operating budgets rely heavily on sales and use taxes. The combined rate used in this calculator 8517 is the result of the Oklahoma state rate 45 the 74112s county rate 0367 the Tulsa tax rate 365.

By state law cities are only allowed to raise money through sale taxes. Merchant Services of Oklahoma. Division Sales Tax Manager.

This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Governor Stitts proposal to eliminate the sales tax on groceries is causing some raised eyebrows at Tulsa City Hall. The Tulsa sales tax rate is.

Sales Use Tax Retailer and Vendor Information Information for Cities and Counties Sales Use Tax PublicationsCharts Sales Use Tax Tools Business Sales Tax Business Use Tax Business Forms Withholding Alcohol Tobacco Motor Fuel Miscellaneous Taxes. Rate variation The 74112s tax rate may change depending of the type of purchase. Stitt made the remarks during his.

This is the total of state county and city sales tax rates. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax. CITY SALESUSE TAX COPO CITY RATE CITY SALESUSE TAX COPO CITY RATE COUNTY SALESUSE TAX COPO COUNTY RATE Changes in Tax Rates.

State of Oklahoma - 45. Braden Tulsa OK 74114. Oklahoma City OK Sales Tax.

Sales Tax Service Inc. Job in Tulsa - Tulsa County - OK Oklahoma - USA 74152. Tulsa OK Sales Tax Rate.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax. Stoulil and is located at 3004 S. The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa.

The companys filing status is listed as Otc Suspension and its File Number is 1900513674. ATM Sales Service. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

The December 2020 total local sales tax rate was also 8517. If a city or county is not listed they do not have a sales or use tax. Kevin Stitt said he wants to eliminate the states 45 sales tax on grocery products.

ABOUT OAR Oklahoma Alternative Resources OAR is a 501 c organization that is an advocacy for parents with dependent children who are in need of legal. Tulsa wants clarification on grocery tax elimination proposal. Is an Oklahoma Domestic For-Profit Business Corporation filed On August 8 1984.

The companys filing status is listed as Otc Suspension and its File Number is 1900422628. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. Tulsa County - 0367.

0819 CYRIL 4. The 74116 Tulsa Oklahoma general sales tax rate is 8517. Sales tax at 365 2 to general fund.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. The Registered Agent on file for this company is Thomas R. If the total sales tax on groceries should be eliminated the City of Tulsa would face an annual loss of nearly 22 million.

The Oklahoma sales tax rate is currently. The current total local sales tax rate in Tulsa OK is 8517. The city of Tulsas tax revenue for May 2020 was off 15 from.

Oklahoma offers sales tax refunds for qualified companies. For vehicles that are being rented or leased see see taxation of leases and rentals. There is no applicable special.

2 days agoSenate President Pro Tempore Greg Treat R-Oklahoma City also has introduced a bill to abolish the state sales tax on groceries. The combined rate used in this calculator 8517 is the result of the Oklahoma state rate 45 the 74116s county rate 0367 the Tulsa tax rate 365. For more information and certification contact the Oklahoma Tax Commission at 405521-3133 otcmastertaxokgov.

Effective May 1 1990 the State of Oklahoma Tax Rate is 45. Sales Tax Refunds. For forms visit wwwoktaxstateokus.

The County sales tax rate is.

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

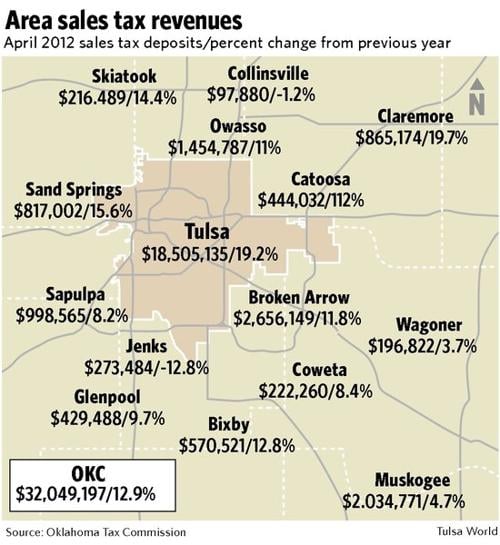

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

How Oklahoma Taxes Compare Oklahoma Policy Institute

How Oklahoma Taxes Compare Oklahoma Policy Institute

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

Total Sales Tax Per Dollar By City Oklahoma Watch